Table of Content

Its best if you need a large sum with predictable payments. USAA mortgage rates are generally lower than other major lenders. That’s because USAA primarily offers VA loans, which have below-market rates thanks to their backing from the Department of Veterans Affairs. But rates vary by customer and loan amount, so you’ll need to request a rate quote to find yours.

If USAA’s phone-based service is problematic for you, consider other lenders with full online capabilities or more brick-and-mortar locations. A home equity loan or line of credit uses the equity you’ve built in your home as collateral. This oftentimes leads borrowers to receive a lower rate with one of these products than what may be offered by a personal loan lender, as personal loans are often unsecured forms of debt.

Home Equity Loan Calculator Usaa

While we are compensated by our lending partners, and it may influence which lenders we review, it does not affect the outcome. It's our mission to give you accurate, transparent information so you can make the best choice of lender or service on or off our site. As far as VA loans are concerned, the loan amount limit is $647,200.

It is however only available to eligible members of the military. And due to the military nature of its membership, USAA is one of the best when it comes to Veteran Administration loans. VA mortgages are loans that are guaranteed by the Department of Veterans Administration. When compared with conventional mortgage types, VA mortgages come with lower interest rates.

USAA cash-out refinancing

Handing out equity loans based on temporarily inflated values is not a smart move for a financial institution. Another plus of going with USAA is that theyre probably well-versed in VA loans, seeing that their members are also members of the military and/or their families. To apply for a loan with USAA, you must first become an USAA member. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

The bank will check your credit and, if you get preapproved, provide you a letter with a preapproval amount that you can use for up to 90 days during your search for a home. You also have to get a COE that confirms you are eligible for a VA-backed loan. You can do a conventional refinance and get up to 95% of the value of your home financed. Theyre basically a full-fledged bank today, but lets learn more about those mortgage offerings, including USAAs mortgage rates, shall we.

Helocs Vs Home Equity Loans: How Do I Decide

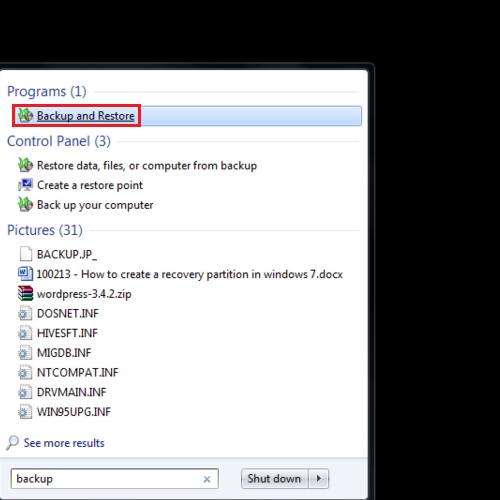

While USAA Bank was one of the first banks to adopt the web as a customer interface tool, you wont find the absolute best operation on the mortgage side. You cant prequalify without logging into your account and youll have to speak to a mortgage representative to get an application started. There also isnt a live chat feature, which is something youll find on other lender websites. HELOCs traditionally have variable-rate APRs, meaning your interest rate adjusts over time based on the benchmark U.S. prime rate.

Once you have been pre-approved and have a contract for a home purchase, you can complete the process with USAA Mortgage through their toll-free number. This website does not constitute a solicitation for business in any state where Cherry cannot lend or broker home equity funds. Cherry Technologies Inc. may also refer qualified homeowners to a licensed partner lender. Void outside the United States and where otherwise prohibited by law. Each payment with a home equity loan will go towards both interest and principal.

Unlike home equity lines of credit, which are adjustable-rate mortgages, home equity loans charge a fixed rate of interest. This rate is usually tied to a major financial index such as the Prime Rate Index, which is published every day inThe Wall Street Journal. However, the interest rates for home equity loans are usually higher than for home equity lines of credit . A potential borrower must be a USAA member to apply for one of their personal loans or mortgages.

You can refinance up to 100% of the value of your home with the ability to choose from a variety of loan terms. In addition to credit score, your loan agent will consider the home price, your income, down payment savings and debt-to-income ratio. However, you still need to prove you have enough money to cover closing costs, mortgage payments and other household expenses. That said, if youre applying for a jumbo home loan, youll need a 20% down payment for a conventional mortgage and 25% saved for a VA jumbo loan. USAA is highly rated for their customer service but in recent months, there have been quite a few complaints online criticizing its services. Still, many customers are very content with the company and use it for all types of financial services.

Firm interest rate for the duration of the loan, which is usually 15 or 30 years. USAA requires a FICO score of at least 620 to get a mortgage. The lender is legally required to tell you why you weren’t approved.

The 2021 JD Power U.S. Consumer Lending Satisfaction Study gave USAA a higher score for personal loans than any of the eight other firms rated. Note that when a lender pulls a credit report, it creates a “hard inquiry.” Too many hard inquiries within a short period can hurt a person’s credit score. So, it’s wise to do some shopping around and narrow down the field of potential lenders before starting to fill out applications. A secured personal loan is backed by collateral, which is an asset the borrower owns and pledges as security for the loan. If the borrower fails to repay, the lender can repossess and sell the asset.

Your home is used as collateral, meaning if you default on your payments, the lender can seize your home. With a home equity loan, youll have a fixed, predictable payment that you can budget for while getting one lump sum of funds for your needs right away. This is advantageous if youre using the funds for a one-time expense.

Loans are flexible, with terms as long as 84 months, and have highly competitive rates and fees so borrowers can feel confident that theyre getting a good deal. USAA is a popular financial company that has a reputation for great customer service. Customers can expect an easy application and strong customer service throughout the borrowing process. USAA members in all 50 states and the District of Columbia can begin their mortgage application process with a USAA loan officer, over the phone or online. And, given its website’s limited functionality, you may end up spending a lot of time on the phone.